It was just another day when we (authors) both were talking about the wonders of Black-Scholes formula and its implications in the financial world. Black-Scholes formula was first introduced to us in the course of Mathematical Finance. We were moved by the idea that a concept which was discovered by a botanist named Robert Brown, “A Brownian Motion of Pollen Grains”, is now frequently used by Wall Street traders to earn money. The same thought grew into curiosity, which prompted us to dig more into interconnections of different sciences with the field of Economics. Like most of you reading this article, at first, we were greatly surprised when we found the existence of such a field, commonly known as, Econophysics which uses borrowed ideas from theoretical physics, quantum mechanics, and some other branches of physics in an attempt to explore the undiscovered laws of finance and economics.

This article primarily discusses three types of areas where models built by physicists have been used to develop a new perspective to look at economics.

Brownian Motion: A concept where physics, biology, and economics come together

Have you ever seen and wondered about how small particles suspended in a fluid behave and have a kind of a jittery motion?

The discovery of Brownian motion is often credited to Scottish botanist Robert Brown. He observed the random movement of pollen grains suspended in water under a microscope. In 1905, almost eighty years later, after Brown, theoretical physicist Albert Einstein published a paper where he modeled the motion of the pollen grains as being moved by individual water molecules, making one of his first major scientific contributions. But a lesser-known fact is that 5 years before Einstein’s miracle year paper, a young French mathematician named Louis Bachelier described a phenomenon very similar to Brownian motion eventually described by Einstein, albeit in the context of asset prices in financial markets. Forgotten for over 50 years, in 1956, Bachelier’s book came into the attention of renowned economist and Nobel laureate Paul Samuelson. He described the scene as,

“When I opened it up, it was as if a whole new world was laid out before me.”

Random walks performed by gas molecules or asset prices obey the Markov process, where future steps are independent of past history given present. In limiting cases, it can be proved that such a random walk tends to what is commonly known as Brownian motion. To understand the concept, first, we need to understand Brownian motion.

Mathematics behind Brownian motion:

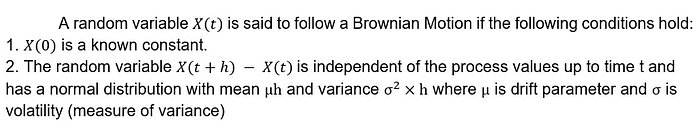

A random variable is said to follow a Brownian Motion if the following conditions hold:

So, in short, each step is independent of previous steps and follows a normal distribution. It is easy to get an intuition of why pollen grains suspended in water undergo a random movement of Brownian motion, but it is hard to digest the fact that stock price movements also follow this type of motion. Here are two arguments usually given by traditional economists to explain why stock prices should follow a Brownian motion -

1. If the short-term variations of asset prices are predictable, then the speculators will be able to find and exploit it by buying undervalued assets and by selling overvalued assets. This itself will eliminate the pattern.

2. Asset prices reflect all available information. Hence, in an informed market, asset prices are automatically adjusted according to the information available. Because if a stock price does not reflect all the available information, investors can obtain a definite gain from it until that information is no longer useful for trading.

The second conjecture is also known as the Efficient Market Hypothesis formulated by Nobel laureate Eugene Fama in his popular paper entitled “Efficient Capital Markets: A Review of Theory and Empirical Work.” To picturize this, we present two visualizations. The first visualization shows one-dimensional Brownian motion performed by a gas particle and the second visualization shows Brownian motion of stock (initially priced at 50). Notice that, when a gas particle jumps by +ε on x-axis, simultaneously, the stock price jumps by +ε. Hence, in this way, the stock price also follows the same Brownian motion as that of a gas particle. As discussed, each step of particle is drawn from a normal distribution independently from its past history.

Therefore, next time before investing in stock market, remember that, if all investors behave rationally and if markets are fully informed, there won’t remain any such thing as ‘beating the market’.

Although Brownian motion by asset prices has been used to derive many mathematical models, including Black-Scholes formula, several economists have also criticized its core assumptions. After all, humans are social animals. Most of our decisions are not characterized by a mathematical definition of rationality. Therefore, such irrational behavior has a significant impact on real markets. Critics of this hypothesis have pointed out that in the short term, if stock prices begin rising, the odds are slightly in favor of it continuing to rise. Market booms and asset bubbles are examples of such irrational exuberance, commonly studied in behavioral finance.

Kinetic Exchange Models of Economic Collisions

Imagine a closed container consisting of gas particles. If the initial number of particles and the total system energy are both conserved, then the Boltzmann-Gibbs distribution is the most probable distribution for energies of particles corresponding to the maximum entropy value. The formula for Boltzmann Gibbs distribution is as follows:

Similarly, consider a hypothetical closed economy where energy is analogous to money, and collisions between particles are similar to monetary interactions between agents. Wealth or total money of this closed economy is conserved over a period. So theoretically, the wealth distribution of our closed economy should also obey the Boltzmann-Gibbs distribution (Now onwards, we will call it BGD). To test this, we carried out an experiment. We took 1000 economic agents in a closed economy. The initial wealth of these economic agents is drawn from random distribution varying from 0 to 1. Then random binary interactions are proposed, in which the total money or wealth remains constant in each interaction. Thus, for two randomly chosen agents i and j, the economic exchange obeys the following expressions:

The model is run for 2×10⁶ iterations, and results are aggregated over 100 realizations. The results can be seen in the figure where histogram represents the number of agents for particular wealth, and the curve is fitted to represent the histogram. And guess what!! The curve follows BGD whereby energy of ith state being wealth and kT is equal to the average wealth of an individual.

Let’s define the Gini index to study wealth inequality in an economy. Gini index is defined as,

G, by definition, is between 0 and 1, where 0 corresponds to a perfect equality in wealth distribution. The measure Gini index for the above simulation is 0.5, which is one of the characteristics of BGD. Note that in a perfectly socialist system, the Gini index will be zero reflecting perfect equality. But at the same time, the entropy of such a system is also zero showing it is statistically less likely to achieve such configuration if we allow free transactions. Knowing this, a wise person can certainly see the similarity between the proposed model and free-market economies.

The surprising thing to note is that over 100 years ago, Pareto made extensive studies in Europe and found that wealth distribution follows BGD for about 90 to 95% of the population. The upper 5% follow a power tail law. Some economists went ahead and found that the wealth distribution of countries like India, UK, and Brazil also follow BGD for lower class of the population. How fascinating!!

Once, while writing about the foundations of statistical mechanics, Boltzmann said that,

“Molecules are like so many individuals, having the most various states of motion.”

We think he had never imagined what he meant would lead to another field of research years after his death. As per our understanding, the key reason behind the replication of kinetic exchange models in the real world is the definition of maximum entropy. There is no external force that drives the system to maximum entropy, but it is just that such distribution is statistically more likely. Yet, some critics have pointed out two fundamental flaws in these models.

First, in the real-world economy, money is not conserved all the time. In fact, central banks like the Reserve Bank of India infuse extra money now and then by lowering interest rates or vice versa by increasing them. Even if the Reserve Bank of India infuses money, initially, it only goes to some major players such as the State of Bank of India or ICICI bank. This causes temporary deviation in Boltzmann Gibbs distribution, but again gradually, our economy starts to converge to the new Boltzmann Gibbs distribution with increased wealth this time. Moreover, if this process is continuous and sufficiently slow, then the economic system will maintain quasi-equilibrium state.

The second problem with the model is its definition of wealth. Generally, while calculating a citizen’s wealth, a nation considers the value of his/her assets/properties other than money. Our model is a replication of a simple exchange economy where all economic agents exchange their initial endowments, but in the production economy, wealth is also generated or destroyed with each transaction. In his famous book “Wealth of Nations” Adam Smith quotes,

“Nation’s wealth is really the stream of goods and services that it creates.”

Consider a two-person economy. Each of them has $20. Now, a person creates a simple hut by using raw woods and leaves and sells to another person for $10. Therefore, in our two-person economy, the first person has $10 in cash and $10 in property, whereas the second person has $30 in cash. If you notice it carefully, money is conserved after transaction but additional wealth is generated due to production of hut.

Numerous models have been built to include this definition of wealth, but most of them aren’t reproducible in the real world. We think the best test for empirically validating this model is to measure the distribution of M1 money (total distribution of liquid cash in each country) to validate these models. Nonetheless, if interested, we will highly recommend you to go through list of references used in this paper.

Black holes and economic singularity

Singularity was originally a mathematical term for a point at which an equation has no solution. In physics, it was proven that a large enough collapsing star would eventually become a black hole. It becomes so dense that its own gravity would cause a singularity in the fabric of spacetime, a point where many standard physics equations suddenly have no solution.

Many economists draw a rough parallel between a black hole and our current global economic situation. An economic bubble of any type, but especially a debt bubble, can be thought of as an incipient black hole. When the bubble collapses in upon itself, it creates its own black hole with an event horizon beyond which all traditional economic modeling breaks down. It is what Rogoff and Reinhart call the “Bang!” moment, when a country loses the confidence of the bond market.

With the loss of confidence, there is a rise of a period of uncertainty, causing massive miscoordination between the plans of millions of economic actors. Amid a recession, workers tend to possess skills that entrepreneurs do not want to employ. Entrepreneurs have projects that investors do not wish to fund. Firms have products that individuals do not buy, and households have savings that firms do not borrow. It is this period when the most fundamental law of economics, an invisible hand, fails to coordinate economic plans of economic agents.

Although the black hole math does not fit the above scenario exactly, in our opinion, it is sometimes beneficial to have a new perspective in order to develop innovative solutions. The inter-linkage of black holes with debt bubbles is one of the examples of such comparisons.

Concluding Remarks

Every time history has taught us that if you want different results, you have to try different approaches. Max Planck once said,

“When you change the way you look at things, the things you look at change.”

Econophysics has remarkably provided us with a novel and innovative way of looking at conventional economics. Like any other model, models developed in Econophysics are not perfect, but they have helped us push the boundaries of our imagination. No wonder, the first Nobel Prize winner in economics, Jan Tinbergen, was a physicist by training. Problems are nothing but wake-up calls for creativity, and we believe that this creativity driven by passion of discovery will continue to surprise us with its miracles.

References

[1] K. Sharma and A. Chakraborti, “Physicists’ approach to studying socio-economic inequalities: Can humans be modelled as atoms?,” no. June 2016, 2016, [Online]. Available: http://arxiv.org/abs/1606.06051.

[2] A. A. Dragulescu, “Applications of physics to economics and finance: Money, income, wealth, and the stock market,” 2003, [Online]. Available: http://arxiv.org/abs/cond-mat/0307341.

[3] “We’re Headed For An Economic Black Hole — Business Insider.” https://www.businessinsider.com/were-headed-for-an-economic-black-hole-2012-10?IR=T.

[4] “Brownian Motion in Financial Markets by Jørgen Veisdal Cantor’s Paradise | Medium.” https://medium.com/cantors-paradise/brownian-motion-in-financial-markets-ea5f02204b14.

[5] E. R. Mexicana et al., “Brownian motion , diffusion , entropy and econophysics,” vol. 65, no. June, pp. 1–6, 2019.

[6] M. Patriarca and A. Chakraborti, “Kinetic exchange models: From molecular physics to social science,” Am. J. Phys., 2013, doi: 10.1119/1.4807852.

This story is co-authored by Deovrat Mehendale. Both the authors are with Indian Institute of Technology, Madras, India.

No comments:

Post a Comment